The Know Better, Do Better (KBDB) Collaborative, an initiative of ChemFORWARD, a non-profit focused on consumer exposure to toxic chemicals, has released its 2025 Beauty & Personal Care Ingredient Intelligence Report. The Collaborative, whose members include Sephora, Ulta Beauty, The Honest Company, and Dow, has expanded the scope of this year’s analysis from last year’s baseline report: researchers analyzed more than 48,000 products and 1.25 million disclosed ingredients, a five-fold increase in data since 2023.

For key takeaways from the report, including a breakdown of its findings and ways the industry can continue to build efforts to improve ingredient safety in beauty and personal care products, we interviewed Bill Walsh, Director, Safer Chemistry Impact Fund, Heather McKenney, Science & Safer Chemistry Lead, ChemFORWARD, and Stacy Glass, Co-founder and Executive Director, ChemFORWARD for their insights.

CDU: The 2025 report shows that 76% of ingredients are now characterized for safety, up from 70% in 2023. How significant is this level of progress for manufacturers and suppliers, and what does it signal about the industry’s overall commitment to safer chemistry?

Bill Walsh: This progress is significant in at least three ways. First, it demonstrates a steady commitment to customer well-being beyond mere regulatory compliance and centers on safer chemistry as part of standard operating procedure for trusted brands in this business.

Second, closing the ingredient knowledge gap would require too great a financial commitment for any single company to undertake. Ideally, chemical suppliers would routinely include hazard data on the formulations they provide to the market.

Until they do so, however, it is significant that these brands have made clear that uncharacterized ingredients are unacceptable, and have pioneered a pre-competitive collaboration for accelerating the pace of research and reporting year-over-year results.

Third, sharing the chemical hazard assessments they have commissioned in the Chemical Hazard Data Trust makes this information actionable industry-wide.

Heather McKenney: At the same time, it’s not nearly enough progress. While significant progress has been made in characterizing ingredients and reducing the use of chemicals of concern, opportunities remain, particularly with regard to uncharacterized ingredients (24% of all ingredients).

By nature, uncharacterized chemicals cannot be considered safer chemistry since their hazards are unknown. The path forward is clear: the BPC industry must accelerate the elimination of problematic ingredients, prioritize assessment of uncharacterized ingredients, and continue to invest in shared, high-quality chemical hazard assessments to benefit the entire value chain.

The progress to date does prove that by working together, supply chains can rapidly close the information gap and create a safer, more transparent industry for everyone.

CDU: Despite the progress, nearly a quarter of all ingredients remain uncharacterized. From your perspective, what are the biggest barriers preventing full ingredient characterization, and how can suppliers better collaborate with brands and retailers to close these data gaps?

Stacy Glass: There are three things. First, changing the narrative. The industry is largely still operating from a place of regulation and restricted substances. What the report demonstrates is a significant change in the narrative: It is now possible to move beyond regulations and restricted substances lists in the pursuit of safer ingredients and clean beauty.

Consumers and investors alike can expect and should insist upon science-based, data-driven reporting of ingredient safety on both human and environmental impacts, which was just not possible before.

Second, a historical lack of collaboration in this space. “Many hands make light work,” especially when we are creating a shared dataset to enable the transition to safer chemistry. The more companies that contribute to the work of populating the shared Chemical Hazard Data Trust, the faster this phase of characterization will go.

We are playing catch-up now to fill the knowledge gaps, but we can imagine a day when human and environmental hazard data are readily available and all new ingredients entering the market are well characterized for human and environmental impacts from the beginning.

Finally, supplier leadership. Suppliers are in the best position to know and assess ingredients in the formulations they provide to brands. It should be standard operating procedure for suppliers to provide this information.

In this collaboration, we have two great examples highlighted in the report - one from Dow and one from Inolex. Both companies have done the hard work of having dozens of their trade name ingredients assessed through a rigorous third-party process to verify their safety.

Leading suppliers can proactively have their trade name ingredients assessed and distinguish themselves in the marketplace with verified safer claims.

CDU: The report identifies lingering issues with certain ingredient classes, such as synthetic dyes in lip color or emollients in moisturizers. Where do you see the greatest opportunities for innovation to replace these high-hazard ingredients without compromising product performance or consumer expectations?

Heather McKenney: There exists an opportunity to innovate alternatives to organochlorine and organobromine colorants that meet performance criteria.

The trend of more high-hazard chemicals was only observed in lip color, so a focus on innovative colorants used to achieve lip color benchmarks could help accelerate the adoption of safer chemistry in a product type that is expected to be of elevated exposure due to incidental ingestion. With color cosmetics, exploring combinations of pigments to achieve the same benchmark may be an option.

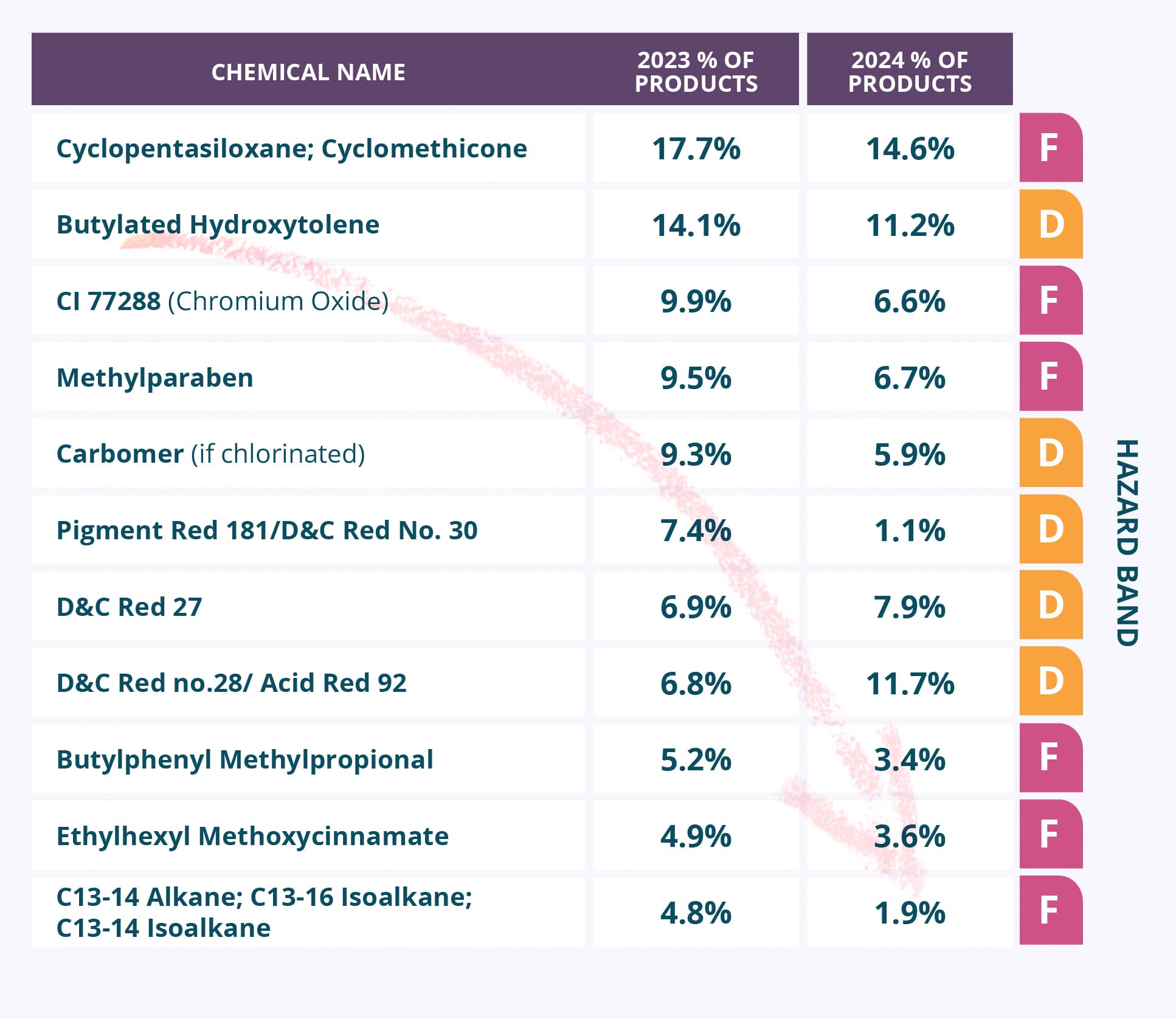

Our high-level analysis of emollients showed that a few functional emollients are in high use and could offer innovation opportunities. Particularly, cyclic silicones such as cyclopentasiloxane or cyclomethicone were used in 14.6% of products in the dataset.

Further analysis would need to be conducted to analyze which functionality these materials impart per product, as uses range from skin conditioning to spreadability to quick-dry, and innovation should follow function while also reducing hazard. The Inolex material case study in the report highlights an example of an innovative alternative to cyclomethicone for use in skin and haircare applications.

CDU: The report notes that investors are paying closer attention to chemical management practices in supply chains. How are regulatory, investor, and consumer pressures converging to shape ingredient selection and product development strategies in 2025 and beyond?

Bill Walsh: The beauty and personal care sector is undergoing a profound transformation driven by a surging demand for safer ingredients. This shift is accelerated by a confluence of heightened consumer and investor awareness, evolving regulatory frameworks, persistent non-governmental organizations (NGOs) advocacy, and strategic innovation by leading brands.

One concrete example of this is the decision of KBDB Collaborative members’ acknowledgement that market growth for “clean” products has outpaced formal definitions for “clean,” leading to ambiguous claims and consumer confusion.

With this report, they are making a commitment that “clean” is clearly defined, tracked, and quantified through ingredient transparency, hazard characterization based on comprehensive toxicology, and validated with third-party evaluation and reporting

The market for “clean beauty” is evolving, underscoring the need for mainstream adoption and long-term trajectory of the science, metrics, and verification to underpin a transparent marketplace.

This report affirms that the journey toward full ingredient characterization is achievable. The model of conducting ingredient audits, investing in chemical hazard assessments, and phasing out high-hazard chemicals is a clear pathway for the industry to transition to safer chemistry and measure its results.

The Know Better, Do Better Collaborative’s work serves as a successful model that can be scaled, proving that shared data and collaboration are powerful tools for driving safety and informed decision-making while reducing brand and investor risk.

CDU: The KBDB Collaborative brings together retailers, brands, and suppliers, an approach that’s still relatively rare in this sector. What do you see as the key advantages (and challenges) of this type of pre-competitive collaboration for driving systemic change in ingredient safety and transparency?

Stacy Glass: For members of the Know Better, Do Better Collaborative, “clean” is clearly defined, tracked, and quantified through ingredient transparency, hazard characterization based on comprehensive toxicology, and validated with third-party evaluation and reporting. A harmonized, science-based definition of “clean” provides formulation and claim support.

The Collaborative’s Charter is based on the belief that lack of information on chemical safety is unacceptable and members have committed to collaboratively pursuing chemical hazard assessments—a process called characterization—to fully understand human and environmental impacts.

Collaborative members measure progress in the use of comprehensive chemical hazard assessments (CHAs) and data analytics to quantify the use of safer chemistry, identify chemicals of concern beyond regulations, and prioritize uncharacterized chemicals for investment in CHAs. By sharing anonymized, aggregated data, each member can observe trends in chemical use and hazards on a scale much larger than their individual organization.

Collaborative members benefit from significant cost and time savings as members gain access to all chemical hazard data in the system, regardless of which organization sponsored the chemical hazard assessment. This allows more rapid, safer chemistry decision-making, including the development of data-driven chemical management policies.

Collaborative members are early adopters of this approach, and thus are seeking broader adoption of this approach to achieve the change they seek in the market. This group is moving beyond regulatory compliance and restricted substances lists, which may pose supply chain challenges when seeking verified, safer alternatives. Additionally, with any new benchmark, understanding and buy-in within and across organizations will take time.

CDU: Given that safer chemistry is both a scientific and business imperative, what actionable steps should suppliers and manufacturers take now to align with this emerging benchmark and remain competitive in a market increasingly defined by ingredient transparency?

Heather McKenney: The most efficient and effective step would be for suppliers, who are in the best position to know and address chemical hazards in their formulations, to provide standardized and independently verified chemical hazard assessments for the products they sell into the BP&C market.

Suppliers specifically should pursue trade name review for safer materials. The SAFER trade name designation exists to review trade names, as complex mixtures, on the market to provide a portable claim for prospective buyers, thus expediting the identification of safer materials for formulators: a win-win!

For brands, first conduct an Ingredient Intelligence Report—a full inventory of the chemicals used in their products—to understand what is known and what is not. From this baseline, adopt policies, establish an action plan, and commit to time-bound goals for addressing high-hazard chemicals and uncharacterized chemicals. This is the first step in proactive chemical management.

Next, set goals and measure progress against those goals. This report provides four key metrics that can be used by individual companies:

- Percentage of characterization;

- Percentage of verified safer chemistry;

- Percentage of chemicals of high concern, and

- Percentage of uncharacterized chemicals.

These metrics can be reported year over year to track progress toward safer chemistry.

Finally, invest in characterization and the pursuit of verified safer alternatives. Companies should invest in uncovering safer alternatives through characterization, and when safer alternatives do not exist, invest in developing safer chemical alternatives and create incentives for their suppliers to do the same. This helps to drive innovation and meet growing market and regulatory demands for safer products.