After several years of rapid expansion, the beauty industry is entering a more complex phase. McKinsey & Company has reported that the global beauty market grew at a rate of 7% annually from 2022 to 2024. Looking ahead, “we expect the global beauty market to grow 5% annually through 2030,” McKinsey stated in its State of Beauty 2025: Solving a Shifting Growth Puzzle report.

Although the overall trajectory remains positive, multiple factors are reshaping the path forward. “Geopolitical and economic uncertainty, market saturation, and evolving consumer preferences threaten that progress,” the report noted, requiring beauty players to “recalibrate by reorienting themselves toward high-growth markets, reconsidering the value they bring to their products, and refreshing their commercial functions.”

Regional rebalancing required

McKinsey highlighted shifting regional opportunities and risks. While the U.S. market remains strong, “political volatility clouds forecasts.” In China, midterm recovery is expected, but “growth is unlikely to reach pre-pandemic rates.”

Additionally, Europe is projected to expand in line with global trends, but “economic challenges may dampen volume growth in the region,” the report authors wrote.

In contrast, the report also highlighted that some emerging regions are gaining attention. “Global beauty executives we surveyed say they are looking to India and the Middle East for the industry’s most promising growth,” McKinsey reported.

However, success will depend on cultural fluency: “Growing there means brands need to familiarize themselves with local consumer preferences and tastes and adapt to them.”

Consumers prioritize value and performance

The report examined how consumer behavior is evolving in ways that pressure traditional value propositions. “Consumers are value conscious, skeptical of hype, and laser focused on whether products deliver,” according to McKinsey.

The report identified growing scrutiny of performance, especially in higher-priced segments, with selective splurging now common.

“Skin care items such as facial serums are more splurge-worthy than facial cleansers or lip balms,” McKinsey noted. Product quality now ranks as the top purchase driver, while “public-facing founders are among the lowest consumer consideration factors.”

Additionally, 83% of consumers in the McKinsey survey agreed hair care was affordable, but only 67% reported the same of fragrances, which highlighted growing pressure across price tiers to justify costs.

Marketing and sales must evolve

Marketing and distribution strategies are also facing shifts despite market headwinds. “The saturation of paid-marketing channels has made digital ads less effective and more expensive,” the McKinsey report observed, with brand storytelling and originality expected to play a larger role in capturing attention.

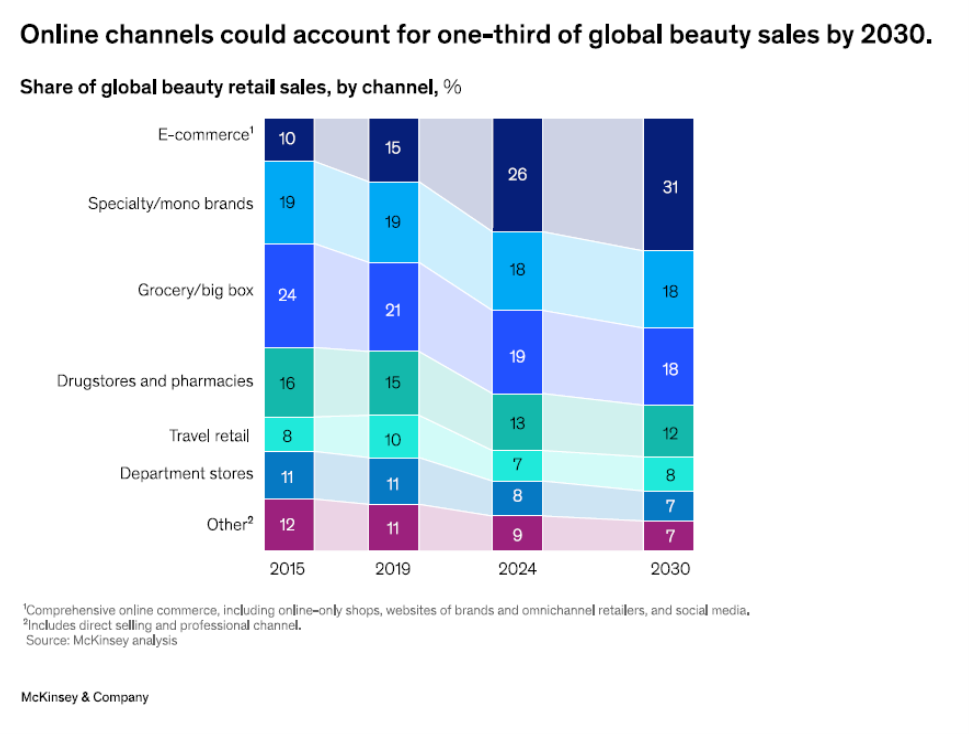

Distribution channels, too, are undergoing a fundamental shift as digital growth reshapes consumer behavior and operational strategies. According to McKinsey, “we expect online channels to account for nearly one-third of global beauty sales by 2030,” up from 26% in 2024. This projected change will make e-commerce the largest single channel in the category.

This shift, however, doesn’t signal the end of physical retail. “Consumers still prefer brick-and-mortar stores for discovery and purchase,” McKinsey noted. However, digital marketplaces have emerged as the primary destination for replenishment and convenience shopping, particularly given the widespread availability of discounts and rapid delivery.

For manufacturers and suppliers, this channel evolution demands more than just an e-commerce presence. McKinsey advised that rather than competing on speed or promotions, brands should “focus on creating compelling omnichannel shopping experiences and exploring the use of tools such as agentic commerce.”

AI adoption remains promising

Despite growing interest in artificial intelligence (AI), adoption remains uneven. “Only 10% of executives surveyed are using AI regularly, and 60% are still in an exploratory phase,” McKinsey stated.

Functions such as R&D, social listening, and personalized marketing are likely to benefit the most, but with caution required in customer-facing applications to maintain trust.

The beauty industry remains a global force, but according to McKinsey, its current phase demands recalibration. “The era of more-is-more consumption has ceded ground to a new focus on value, differentiation, and individuality,” the report concluded. Success in this evolving landscape will depend on brands’ ability to redefine value, adapt across regions, and reconnect with an increasingly discerning consumer base.