All three are related and in the best case scenario, media and influencers are well-armed with objective information, substantiation and data that allows ingredients and brands to differentiate in market and the category to organically grow with efficacious products at reasonable margins for all.

That’s certainly the plan for the responsible players in the collagen space. There are three highly interwoven markets at work in the collagen category. Clearly, much of the hype and excitement is about growth in beauty and skin health applications, and there is a surprising diversity in consumers seeking these benefits – both female and male. These applications are also benefiting from changes in lifestyle and life pressures over the past few years driving all types of consumers to take better care of themselves – including how they look.

The next obvious benefit area is the continued development of the bone and joint health market, and the essential role collagen and related science will play. As active consumers also change their lifestyles to take better care of themselves to age better, formulations with several different types of substantiated collagen products are proliferating on store shelves. Lastly, and related to but slightly separate from this active environment is the position of collagen in next generation sports nutrition, both as a protein source, but also as a functional structural ingredient.

We are only at the start of this journey, yet it’s clear to see the excitement and demand from consumers, industry, and investors especially in the sports and active nutrition environment. This includes seeing collagen as a protein source in functional foods and drinks too, where it’s favorable stability and characteristics make it an interesting and easy addition to drinks and bars.

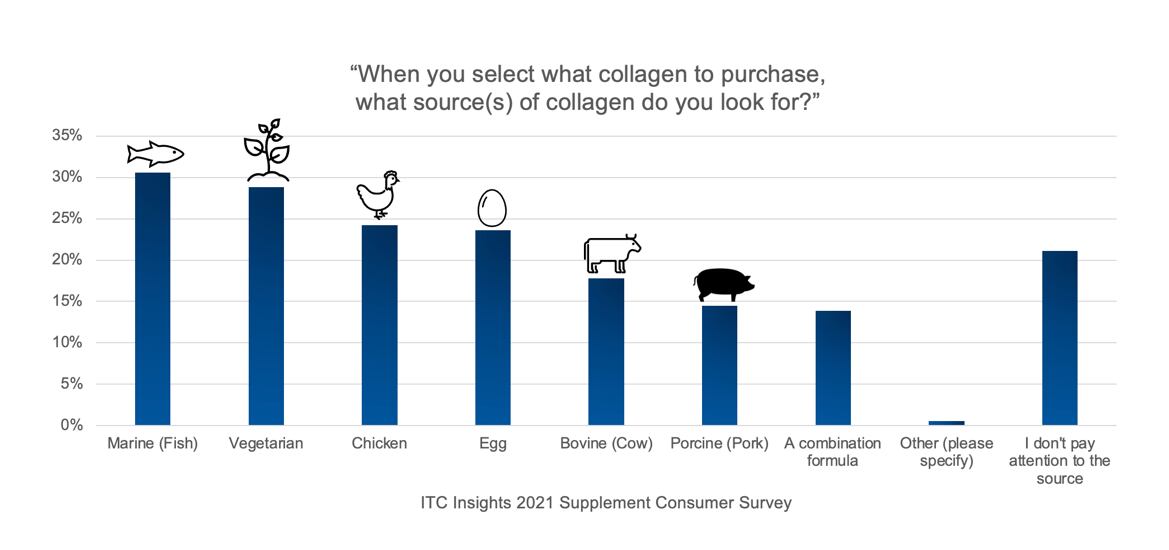

To truly understand this category, one must dive deep into the various differentiation strategies in the category, at ingredient and at brand level. Source is the first obvious differentiator that is a determiner of type of collagen, base of science and consumer value proposition. We are starting to see marine and bovine source really push their own agendas when it comes to claims such as ‘grass fed’ or sustainably sourced.

We’ve seen growth in organic claims around bovine collagen, and companies in the marine collagen space continue to look towards certifications such as MSC as a way to differentiate on a quality and ethical level – and support loyal consumers’ values at the same time. And of course, the market has chicken and porcine sources, sometimes identified, increasingly with seals and certifications as a market differentiator.

Consumers increasingly cite source and value concerns as reasons they choose collagen products. There is still significant confusion over vegetarian collagen sources as plant-based diets and preferences promulgate with consumers being misled by terms such as ‘plant-based collagen’. On the positive side, we are seeing increasing transparency with companies using the term ‘collagen boosters’ to describe their plant-based alternatives to formulas containing collagen.

It’s clear that demand for plant-based and vegan collagen is high among consumers and industry. This presents an interesting challenge and opportunity for an ingredient that is clearly an animal product, since collagen is a structural animal protein, not naturally found in any plants. While some biotechs are doing a wonderful job of developing non-animal sourced bio-identical collagen, these products are not yet on the market – and even when they are, will likely be at the super-premium end of the market.

On the combination formula side, we are also seeing formulas of collagen peptides alongside these boosters - a formulation strategy we expect to continue – especially in supplements and liquid shots.

In 2022, expect the communication on both ingredient and brand differentiation strategies to heat up significantly, and the vegetarian collagen dialogue will not go away. There is ample room for this differentiation as the outlook for the market is strong and supported by new science in all three development areas and the value-based proposition in the collagen market is perhaps the strongest of any ingredient category. There will also be work being done in analytical method development and standardization even as suppliers differentiate. And we expect more suppliers and brands to work together to expand the category through education.