Market saturation and environmental concerns compromise silicones demand

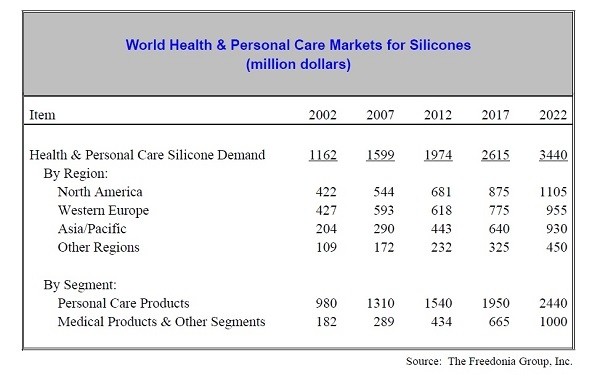

World demand for silicones in the health and personal care market it predicted to grow at 5.8 per cent a year to reach an estimated value of $2.6 billion (€2.0bn) by the year 2017, according to latest market research from the Freedonia Group.

The market researcher points out that geographically it is North America that is by far the largest market, but that emerging markets are likely to fuel future growth, as the developed markets are now highly mature.

Personal care likely to see slower growth

The researchers also point to the fact that the specific market for silicones in personal care products is also likely to see less growth than for applications in the health care sector.

Beyond the high levels of penetration within the personal care market in developed countries, the report also highlights the fact that growth is likely to be compromised due to increasing concerns and awareness regarding environmental and health issues relating to silicones in formulations.

Currently personal care products being formulated with silicones include deodorants, hair colorants, hair conditioners, lipsticks, mousse and sun care products, to which the ingredient is said to impart good feel and performance characteristics.

Natural alternatives to silicones

However, the research points to the fact that increasingly formulators are looking for natural alternatives to silicones, in an attempt to improve the environmental footprint of products and to give them a better profile for increasingly discerning consumers.

The research group points to alternative ingredients that include Croda’s Crodamol SFX as a replacement for cyclomethicone (cyclopentasiloxane, or D5) in cosmetic and toiletry formulations, while BASF is offering alkyl polyglucosides as a renewably sourced alternative to silicone conditioning agents in shampoos.

Despite these alternatives, silicones remain particularly popular ingredients of choice for formulators working in both the hair care and the colour cosmetics category.

In hair care products, silicones are said to impart both shine and manageability to a cross-section of products, from shampoos and conditioners, to hair styling formulations, while in the colour category silicones are traditionally included in formulations to improve the performance of lipsticks, eye shadow and foundation.